Crossing the 500 crore mark in its annual net profits, J&K Bank registered highest ever profit of Rs 512.38 crore for the financial year 2010, which is up by 25% from Rs 409.84 crore recorded during the corresponding year.

The net profit for the quarter ended March, 2010 increased by 53 % and stood at Rs 120.04 crore compared to Rs 78.68 crore earned during the corresponding quarter, 2009.

The Bank announced this during the review of financial results for the quarter and financial year ended March, 2010, by the bank's Board of Directors in a meeting held here yesterday.

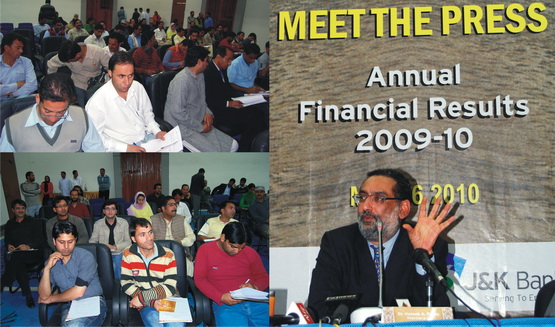

Dr Haseeb A Drabu Chairman and CE J&K Bank today gave a detailed presentation of the Bank's performance for the last five years during ‘Meet the Press' event held at SKICC, Srinagar.

Terming the achievement of the last five years as a process of ‘quiet transformation', Dr Drabu said, "After the consolidation phase of last five years, today we are among the most stable and efficient banks in the country in terms of basics, business and returns. Now our focus would be on growth".

He said, "The total business turnover of the bank has increased by 12% YoY and moved up from Rs 53935 crore to Rs 60294 crore. In the next two years, we have given ourselves the target of achieving the total business of Rs 1 Lac crore besides 1 thousand crore profit".

Elaborating upon the various steps that bank took in the last five years, Dr Drabu said, "For the last 5 years, our approach was mainly inward looking. We focused on consolidation by changing the composition of advances like we increased our credit deployment in J&K exponentially from 1200 crore to 12000 crores. We managed our liabilities well and restructured our lending in ROI", he added.

The Operating Profit for the year ended Mar, 2010 has increased by 24 % YoY to Rs 958 crore from Rs 774 crore earned during the previous financial year. Operating Income (Net Interest Income + Other Income) for the current year was Rs 1536 crore as against Rs 1245 crore for the last fiscal registering an increase of 23 %.

| Business Highlights for FY ‘10 |

Total Business up by 12 % YoY at Rs. 60294 Crore

Total Assets up by 13 % YoY at Rs. 42547 Crore

Total Advances up by 10% YoY at Rs 23057 Crore

Total Deposits up by 13 % YoY at Rs 37237 Crore |

| Performance Highlights for FY ‘10 |

Net Profit up by 25 % YoY at Rs 512.38 Crore

Operating profit up by 24 % YoY at Rs 958.20 Crore

Total Income up by 7 % YoY at Rs 3473.11 Crore

Interest earned on advances for FY 9-10 up by 2%

Other income up 70 % YoY at Rs 416.23 Crore |

These profits are driven by the substantial improvement in the bank's Fee Based Income (Other Income) during the current Financial Year, which is up by 70 % from Rs 245 crore to Rs 416 crore, the major contributor being Treasury / Trading Income.

The Loan Book as on March 31, 2010 stood at Rs 23057 crore up by 10 % from last year's Rs 20930 crore. The Bank's Deposit base at the same date stood at Rs 37237 crore up 13 % from Rs 33004 crore as on March 31, 2009.

The Return on Assets for the current year improved to 1.20 % compared to 1.09 % for the previous financial year. With the leveraging of technology and managing costs efficiently, the Bank continues to bring down its Cost to Income ratio which is at 37.60 % for the year ended Mar, 2010 compared to 37.81 % a year ago.

The Gross NPAs as on Mar, 2010 have declined considerably to Rs 462.31 crore from Rs 559.27 crore a year ago. The NPA Coverage Ratio as on Mar, 2010 is at 86 % up from 49 % a year ago and well above the RBI stipulated norm of 70 %.

The investments of the bank as on Mar 31, 2010 grew by 30 % YoY to Rs 13956 crore.

Of the total investments 68.7 % are in the HTM category, 31.2 % in the AFS category and rest in the HFT category. The SLR securities form 61 % of the total Investments. Net Worth of the Bank as on March, 2010 stood at Rs 3010 crore compared to Rs 2623 crore a year earlier, registering a growth of 15 %.

The low cost Demand and Savings Deposits of the Bank as on Mar, 2010 are at Rs 15153 crore up by 20 % YoY from Rs 12579 crore as on Mar, 2009 taking the CASA ratio up to 40.69 % from 38.11 % a year ago.